1. Executive Summary

This report outlines a strategic framework for pharmaceutical printing companies to integrate drug patent litigation intelligence into their business-to-business (B2B) marketing efforts. By proactively monitoring and interpreting legal events, particularly those stemming from the Hatch-Waxman Act, printing companies can anticipate the evolving needs of both brand-name and generic pharmaceutical clients. This approach enables the delivery of highly relevant, timely, and specialized services, unlocking new revenue streams and strengthening client partnerships within the dynamic pharmaceutical market. The report emphasizes how a deep understanding of these predictable legal triggers transforms a printing company from a mere supplier into an indispensable strategic partner, directly contributing to a pharmaceutical client’s market success and regulatory adherence.

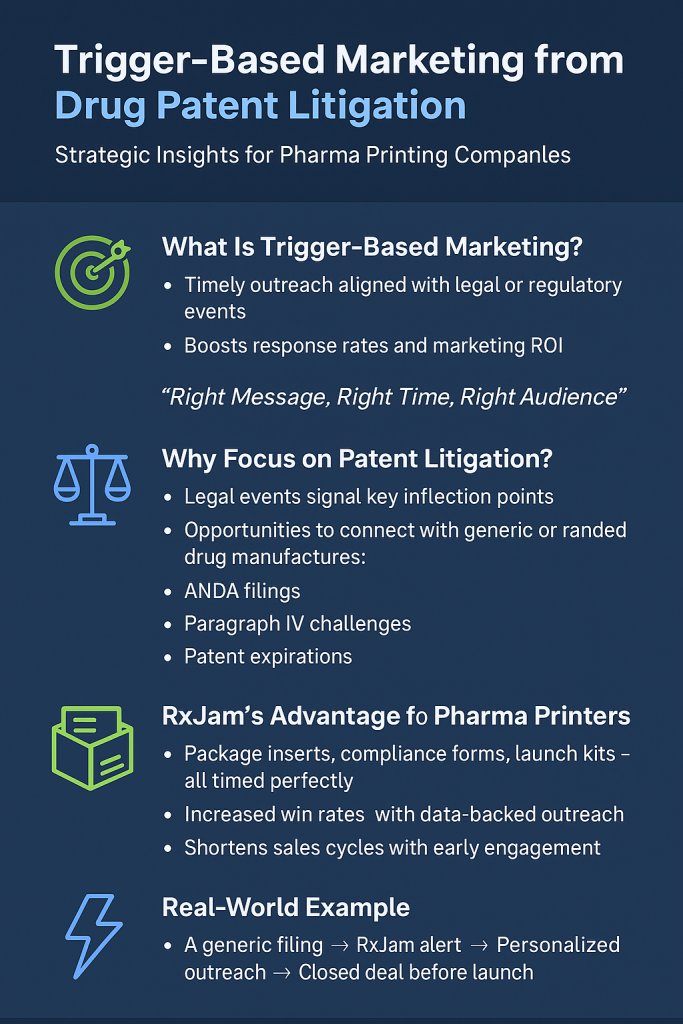

2. Introduction: The Strategic Imperative of Trigger-Based Marketing in Pharma Printing

The Critical Role of Pharmaceutical Printing in Drug Development and Commercialization

Pharmaceutical printing companies are far more than mere suppliers; they are essential partners in the intricate drug lifecycle, playing a pivotal role in ensuring patient safety, informing healthcare professionals, and maintaining regulatory compliance. These companies are responsible for delivering a wide array of precise and reliable printed materials, which are fundamental to the successful development and commercialization of pharmaceutical products. This extensive portfolio includes critical items such as package inserts (PIs), medication guides, physician instructions, brochures, booklets, and comprehensive care guides, all of which must convey essential details about treatment plans, delivery methods, and potential side effects.1

Beyond these foundational materials, pharmaceutical printing services extend to the meticulous assembly and coordination of product launch kits, customized patient kits designed to enhance satisfaction and compliance, and various training materials for internal teams.1 They also produce direct mailers targeting physicians and pharmacies, as well as a range of promotional items for sales teams, including logo apparel and recognition awards.1 The scope of services often encompasses large-format conference materials like banners, backdrops, and table displays.1 Furthermore, modern pharmaceutical printing companies offer sophisticated solutions such as inventory management, supply chain coordination, and advanced brand security features like RFID and barcoding.2 Adherence to stringent quality standards, including ISO 13485 and cGMP, is non-negotiable, as is navigating the complex and ever-evolving FDA requirements and labeling guidelines.2 The industry’s fast-paced and complex nature demands that printing partners operate with exceptional speed and reliability, ensuring flawless, on-time delivery while meeting budget constraints.1 This operational agility, ensuring materials are precisely where they are needed, exactly when and how they are needed, elevates printing companies beyond mere vendors to strategic enablers whose capabilities directly influence a pharmaceutical company’s ability to seize market opportunities and fulfill regulatory obligations. Their consistent ability to deliver under tight deadlines transforms their services into a competitive advantage for their clients.

Defining Trigger-Based Marketing and its Relevance in the B2B Pharmaceutical Landscape

Trigger-based marketing is a strategic approach that identifies specific events or signals within a target company that indicate a timely and often immediate need for a particular product or service.6 These triggers can originate from various levels within an organization, including corporate shifts, departmental changes, or even legislative and regulatory developments.6 The essence of this strategy lies in its proactive nature: rather than broad outreach, it focuses on precise engagement when a client’s specific circumstances create a clear demand.

In the highly regulated and intensely competitive pharmaceutical industry, anticipating and responding to these needs is not just beneficial but crucial. The market dynamics are profoundly influenced by patent expirations, new drug approvals, and ongoing regulatory changes.7 B2B pharmaceutical marketing, unlike direct-to-consumer strategies, primarily targets other businesses, such as healthcare organizations, hospitals, pharmacies, research institutions, and distributors.7 Success in this environment hinges on building strong, enduring relationships and delivering valuable, evidence-based content that resonates with key decision-makers.9 Regulatory adherence, scientific credibility, and precision are paramount in all marketing communications.9 By understanding the specific triggers that impact these stakeholders, pharmaceutical printing companies can tailor their offerings to address immediate pain points and opportunities, thereby enhancing their relevance and value proposition.

Overview of Drug Patent Litigation as a Unique Source of Actionable Triggers

Drug patent litigation, particularly the specialized procedures established under the Hatch-Waxman Act, represents a unique and highly actionable source of predictable legal events that directly impact market entry timelines for both brand-name and generic drugs.10 These legal proceedings, while complex, follow a structured pathway that generates distinct milestones. For a pharmaceutical printing company, these milestones are not just legal footnotes; they are powerful, forward-looking signals that indicate an impending need for specific printing, packaging, and related services.

The initiation of such disputes, especially through Paragraph IV (PIV) certifications by generic manufacturers, is a statutorily defined process.10 This “artificial act of infringement” is a deliberate step taken by generic companies to gain market access, which, in turn, triggers a predictable legal response from brand-name manufacturers. This inherent predictability within the legal framework allows printing companies to anticipate the subsequent operational needs of both brand and generic clients. By transforming these legal events into clear marketing opportunities, printing companies can position themselves as knowledgeable partners who understand the intricate legal landscape and its direct operational implications for their clients. This proactive stance enables them to develop pre-emptive marketing campaigns and service packages tailored to these specific legal milestones, rather than merely reacting to general market shifts.

3. The Pharmaceutical Printing Landscape: Services and Value Proposition

Comprehensive Overview of Services

Pharmaceutical printing companies offer an extensive suite of services that are indispensable across every stage of a drug’s lifecycle, from its initial research and development phases through regulatory approval, market launch, and post-marketing activities. These services are meticulously designed to meet the stringent demands of the pharmaceutical industry, ensuring accuracy, compliance, and patient safety.

At the core, these companies produce essential regulatory and patient information materials. This includes detailed Package Inserts (PIs), Medication Guides, and Instructions for Use (IFUs), which provide critical dosing, safety, and usage information.1 They also create comprehensive booklets, care guides, and patient information leaflets that must be clear, accurate, and aligned with FDA-approved specifications to ensure patient safety and medication effectiveness.2

Beyond informational inserts, a significant portion of their work involves packaging and labeling solutions. This encompasses a wide variety of pharmaceutical labels—such as vial labels, shrink sleeves, smooth peel labels, piggyback labels, and extended content/booklet labels—along with cartons, boxes, and highly customized patient kits.2 These solutions cover both primary packaging (in direct contact with the drug) and secondary packaging (like cartons and inserts).14

To support market entry and ongoing promotion, printing companies provide extensive product launch and sales support materials. This includes assembling custom product launch kits that combine literature, PIs, and promotional items for sales teams, warehouses, or direct delivery to physicians.1 They also produce new hire kits, annotated sales aids, direct mailers targeting healthcare professionals, and various promotional merchandise like logo apparel and recognition awards.1

Furthermore, they develop specialized training and conference materials, such as blueprints, playbooks, banners, backdrops, and table displays, crucial for educating internal teams and engaging external stakeholders at industry events.1

Finally, many modern pharmaceutical printing companies offer digital integration capabilities, including customer portals and literature management systems.2 They can also leverage FDA-accepted SPL (Structured Product Labeling) Drug Listing files as a source for manufacturing package inserts, marketing media, and product web pages, streamlining the content creation process and ensuring consistency across formats.5

Emphasis on Quality, Compliance, Security, and Speed as Core Differentiators

In the highly regulated pharmaceutical sector, the ability of a printing company to consistently deliver on quality, compliance, security, and speed is not merely a service offering but a fundamental competitive differentiator.

Compliance is paramount, with printing companies demonstrating strict adherence to FDA-approved specifications 2, ISO 13485, and cGMP (current Good Manufacturing Practices) guidelines.2 This also extends to HIPAA-compliant printing for sensitive medical materials.3 The regulatory framework for labeling and artwork is exceptionally stringent, and even minor non-compliance issues can lead to costly delays, product recalls, or severe legal penalties.9 Therefore, a printing company’s proven expertise in navigating these complex requirements is a critical value proposition.

Quality and Accuracy are non-negotiable. Pharmaceutical printing companies must ensure “proven quality with digital inspection” 2 and commit to “pinpoint accuracy” 1 and “zero defects through 200% inspection systems”.16 The accuracy of packaging artwork is particularly vital, as errors can have significant regulatory and legal consequences.14

Security features are increasingly crucial to protect against counterfeiting and ensure product integrity. Printing companies offer advanced solutions like RFID labeling for tracking, microtext for authentication, temperature and light-reactive indicators, tactile and braille elements, and various tamper-proof features.2 Secure facilities with 24/7 access control and monitored waste stream management further reinforce their commitment to product security.3

Finally, Speed and Reliability are critical in a fast-paced industry characterized by tight schedules and growing workloads.1 The ability to “move as fast as you do” 1, “speed up your time to market” 2, and guarantee “never a missed deadline” 1 provides a significant competitive edge. This operational agility ensures that pharmaceutical companies can meet critical deadlines for product launches and regulatory submissions, directly impacting their market success.

Table 1: Key Pharmaceutical Printing Services & Their Relevance to Drug Lifecycle Stages

| Lifecycle Stage | Key Client Needs | Relevant Printing Services | Value Proposition/Benefit |

| Pre-clinical/Clinical Development | Trial documentation, Investigator Brochures, Patient Diaries | Training materials, BluePrints, Manuals, Patient Information Sheets | Compliance, Accuracy, Consistency for research integrity |

| Regulatory Submission (NDA/ANDA) | Submission-ready labeling, Mock-ups, Documentation for FDA | Package Inserts (PIs), Labels, Cartons, Booklets, Draft Labeling | Regulatory adherence, Expedited review, Error reduction |

| Product Launch | Comprehensive launch materials, Sales force enablement, Initial patient outreach | Product Launch Kits (literature, PIs, promo items), Annotated Sales Aids, Direct Mailers, Conference Materials | Speed to market, Brand impact, Sales force readiness |

| Marketed Product (Brand) | Patient adherence, Ongoing education, Brand protection | Customized Patient Kits, Medication Guides, Security Labels (RFID, microtext), Direct-to-Physician/Pharmacy Mailers | Patient engagement, Brand security, Market presence |

| Patent Expiry/Generic Challenge | Lifecycle extension materials, Updated labeling, Rapid generic entry materials | New formulation PIs/labels, Enhanced security features, Expedited generic launch kits, “Same-as” labeling | Market exclusivity extension, Rapid market entry, Competitive advantage |

| Post-Marketing Surveillance | Safety updates, New indications, Continued patient support | Updated PIs/Med Guides, Patient education brochures, Regulatory submission updates | Ongoing compliance, Patient safety, Brand reputation |

This table illustrates how pharmaceutical printing companies offer a broad spectrum of services that are intrinsically linked to the various stages of a drug’s lifecycle. By clearly defining these connections, printing companies can help potential clients understand how their specialized capabilities directly support critical junctures in drug development and commercialization. This comprehensive view positions the printing company as a strategic partner capable of addressing diverse and evolving needs, rather than a transactional vendor.

4. Drug Patent Litigation: Understanding the Triggers

Fundamentals of Pharmaceutical Patents and the Hatch-Waxman Act

Pharmaceutical patents are a cornerstone of the drug industry, providing the exclusive right to manufacture, use, sell, and import an invention, typically for a period of 20 years from the date of filing.10 This exclusivity is crucial for pharmaceutical companies to recoup the substantial investments made in research and development (R&D), including costly clinical trials and regulatory approval processes.11 Without such protection, the incentive for innovation would be significantly diminished.

These patents can be broad or specific, covering various aspects of a drug. This includes patents on the active ingredient (the core chemical compound), formulation patents (covering the specific composition, including inactive ingredients and their combination), method of use patents (protecting specific ways of using the drug to treat particular conditions), and process patents (covering the manufacturing methods).11 Strategic filing of these different patent types, including provisional and secondary patents, allows brand-name companies to maximize their patent lifecycles and extend market exclusivity, a practice often termed “evergreening”.17

The Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch-Waxman Act, fundamentally reshaped the pharmaceutical landscape in the United States.11 This landmark legislation established the streamlined approval pathway for generic drugs through the Abbreviated New Drug Application (ANDA) process, balancing the need to incentivize innovator drug development with promoting the timely entry of lower-cost generic alternatives.10 The Act also introduced specialized procedures for pharmaceutical patent disputes, directly linking patent litigation outcomes to the timing of generic drug approvals.10

Deep Dive into Paragraph IV (PIV) Certifications and their Role in Generic Drug Approval

A pivotal mechanism within the Hatch-Waxman Act is the Paragraph IV (PIV) certification. When a generic drug manufacturer seeks FDA approval for its product via an ANDA, it must “certify” against any patents related to the brand-name drug that are listed in the FDA’s “Orange Book” database.10 A PIV certification is a specific declaration by the generic applicant stating their belief, to the best of their knowledge, that a listed patent is either invalid, unenforceable, or will not be infringed by their proposed generic product.10

This certification is not merely an administrative step; it is legally significant. Under U.S. law, filing an ANDA with a PIV certification constitutes an “artificial act of infringement”.13 This statutory provision grants the brand-name drug manufacturer and/or patent holder the right to sue the generic applicant for patent infringement, initiating a formal legal challenge. This structured legal framework, where generic companies intentionally trigger a legal response to facilitate market entry, creates a highly predictable sequence of events that can be monitored and leveraged by ancillary service providers like pharmaceutical printing companies.

Key Litigation Events as Predictable Triggers

The structured nature of drug patent litigation under the Hatch-Waxman Act generates a series of predictable legal events that serve as powerful marketing triggers for pharmaceutical printing companies. Understanding these milestones allows for proactive engagement with both brand-name and generic clients.

- ANDA Filing with Paragraph IV (PIV) Certification: This is the initial and most crucial trigger. When a generic manufacturer submits an ANDA containing a PIV certification, they must notify the patent holder and the brand-name drug manufacturer.10 The FDA even publishes a list of new PIV certifications, providing transparency on these filings.24 This event signals the generic company’s intent to enter the market and the brand’s need to respond.

- 45-Day Window for Brand Lawsuit (Triggering the 30-Month Stay): Following a PIV notification, the brand-name drug manufacturer and/or patent holder has 45 days to file a patent infringement lawsuit against the generic applicant.10 If a suit is timely filed, FDA approval of the generic drug application is generally postponed for an automatic 30 months.10 This “30-month stay” provides a defined period for the parties to litigate their patent dispute.10 This period is a critical window for both brand and generic companies to prepare for future market dynamics. For the brand, it offers time to reinforce their legal position and potentially extend market exclusivity.12 For the generic, while a hurdle, it provides a clear timeframe for operational readiness. This single legal event, the initiation of the 30-month stay, creates two distinct, yet equally urgent, sets of needs for printing services, one for the brand and one for the generic.

- Court Decisions (Invalidity/Non-infringement vs. Valid/Infringed): The outcome of the patent litigation directly impacts the generic drug’s market entry. If the courts determine that the patent is invalid or not infringed, the FDA can approve the generic drug immediately.10 Conversely, if the courts conclude that the patent is valid and infringed, FDA approval is generally delayed until the patent expires.10 These decisions are definitive triggers for subsequent operational activities.

- 180-Day Exclusivity Grant/Forfeiture: The first generic company (or companies) to submit a “substantially complete” ANDA with a PIV certification is typically eligible for a significant 180-day period of market exclusivity upon FDA approval.12 This exclusivity is a powerful incentive, allowing the first generic entrant to capture a substantial market share before other generic versions can enter.12 The FDA actively tracks and updates the status of this exclusivity, providing valuable public information.24 The pursuit and potential grant of this exclusivity creates immense pressure for rapid market readiness.

- Patent Expiry: The ultimate trigger for generic market entry, if litigation does not resolve earlier, is the expiration of the brand-name drug’s patent.10 While patents are typically granted for 20 years from filing, the effective market exclusivity for brand drugs is often closer to 7-10 years post-launch due to the lengthy R&D and regulatory approval processes.25 This fixed date creates a predictable cliff for both brand and generic strategies.

The structured and statutorily defined nature of these pharmaceutical patent disputes, particularly the PIV certification and the resulting 30-month stay, means that the initiation of these legal challenges is highly predictable. This predictability is a significant advantage for pharmaceutical printing companies. It allows them to anticipate the subsequent operational needs of both brand and generic clients, transforming a complex legal event into a clear, actionable marketing opportunity. This enables printing companies to develop pre-emptive marketing campaigns and service packages tailored to these specific legal milestones, rather than merely reacting to general market shifts.

Table 2: Drug Patent Litigation Events as Marketing Triggers and Their Significance

| Litigation Event | Description/Legal Significance | Impact on Brand-Name Pharma | Impact on Generic Pharma | Printing Service Opportunities |

| ANDA Filing with PIV Certification | Generic asserts patent invalidity/non-infringement; notifies brand/patentee.10 | Triggers need for legal defense strategy. | Initiates path to market entry; begins 45-day clock for brand lawsuit. | Draft labeling for ANDA submission, mock-ups, regulatory documentation support. |

| Brand Company Files Suit (30-Month Stay Triggered) | Brand sues generic within 45 days of PIV notice, FDA approval generally postponed for 30 months.10 | Opportunity to reinforce legal position, extend market exclusivity.12 | Market entry delayed; defined period for pre-launch preparations.12 | Brand: New formulation PIs/labels, enhanced security features, patient program materials for lifecycle extension. <br> Generic: Finalizing “same-as” labeling, packaging prototypes, pre-launch kit planning, supply chain readiness materials. |

| Court Decision (Patent Invalid/Not Infringed) | Court rules in favor of generic; FDA can approve generic immediately.10 | Loss of exclusivity; intensified market competition. | Accelerated market entry; urgent need for launch. | Rapid production of final, approved labeling and packaging; expedited launch kits for immediate market entry. |

| Court Decision (Patent Valid/Infringed) | Court rules in favor of brand; FDA approval delayed until patent expiry.10 | Patent upheld; continued market exclusivity. | Market entry delayed until patent expiry. | Brand: Continued production of existing materials, potential for new indications/formulations with updated labeling. <br> Generic: Extended time for supply chain optimization, refinement of launch strategy for future entry. |

| 180-Day Exclusivity Granted | First generic applicant eligible for 180 days of market exclusivity upon approval.23 | Faces first generic competition; potential for significant price erosion. | Unique window to capture significant market share.12 | Urgent, high-volume production of launch kits, sales aids, and patient materials to maximize market penetration during exclusivity. |

| 180-Day Exclusivity Forfeiture | First applicant loses exclusivity due to specific statutory events.24 | Market opens to more generic competitors. | Other generic applicants can now launch. | Rapid production for multiple generic entrants; competitive pricing on print services. |

| Patent Expiry | Patent term ends, opening market to all generic competition.10 | Full generic competition; significant price decline.8 | Opportunity for broad market entry. | High-volume production of standard generic packaging and labeling for multiple manufacturers; potentially lower-cost print solutions. |

This table serves as a quick reference guide for a pharmaceutical printing company’s marketing and sales teams. It translates complex legal processes into actionable business intelligence, detailing specific legal events, their implications for pharmaceutical clients, and the resulting opportunities for specialized printing services.

5. Identifying and Monitoring Litigation Triggers: Tools and Best Practices

To effectively implement a trigger-based marketing strategy, pharmaceutical printing companies must establish robust mechanisms for identifying and monitoring relevant legal events in real-time. This requires leveraging specialized tools and developing efficient internal processes.

Leveraging Legal Intelligence Platforms and Patent Monitoring Services

The pharmaceutical industry benefits from a range of specialized platforms designed to track and analyze intellectual property and market dynamics. These legal intelligence platforms offer “industry-leading drug life-cycle analysis” and provide “critical headlines & day-by-day trial updates” related to significant drug litigation cases.26 Companies like IPD Analytics, for instance, offer comprehensive insights on “loss-of-exclusivity timing,” “innovative, product-launch tracking,” and detailed “brand, generic, and biosimilar launch forecasts”.26 They provide actionable data on drug litigation updates, clinical pipeline tracking, and market impact forecasts, delivered through online platforms, email alerts, and reports.26

In parallel, patent monitoring services act as an “advance warning system” for businesses.27 These services continuously track competitors’ intellectual property rights, identify potential infringement issues, and monitor changes in patent statuses and legal developments.27 They provide automated tracking and alerts for crucial deadlines such as patent filing dates, maintenance fee deadlines, and shifts in legal status, which significantly enhances efficiency and improves strategic decision-making.28 The landscape of legal tech marketing is rapidly evolving, with AI-driven tools offering capabilities for personalized marketing and predictive analytics to anticipate client needs.29 These advancements mean that pharmaceutical printing companies do not need to develop extensive in-house legal expertise to track patent litigation. Instead, they can subscribe to these specialized services, effectively outsourcing the complex legal monitoring to expert providers. This significantly lowers the barrier to entry for implementing a sophisticated trigger-based marketing strategy, allowing the printing company to focus on interpreting the provided data for strategic marketing action.

Establishing Internal Processes for Real-Time Data Acquisition and Analysis

Subscribing to legal intelligence platforms is only the first step; effectively integrating this information into a company’s operations is paramount. Pharmaceutical printing companies must establish systematic internal processes to acquire and analyze this real-time data efficiently. This involves setting up automated alerts from these platforms to notify relevant teams immediately when a significant legal event occurs, such as an ANDA filing with a PIV certification or a court decision.

Regular review of comprehensive reports provided by these services is essential to identify trends and deeper implications. Crucially, this intelligence should be integrated into existing Customer Relationship Management (CRM) systems.29 By linking legal triggers to client accounts, sales and marketing teams can gain a holistic view of a client’s position in the market and their likely future needs. The overarching goal is to transform “raw information into actionable insight” 30, enabling the printing company to anticipate client needs and proactively refine their marketing efforts.29 This proactive approach ensures that marketing and sales outreach is always timely and contextually relevant.

The Importance of Timely Alerts and Competitive Intelligence

In trigger-based marketing, timeliness is paramount. Automated alerts from legal intelligence platforms ensure that pharmaceutical printing companies are immediately aware of significant legal developments, allowing for proactive outreach before competitors can react.28 Missing a critical trigger could mean missing a valuable business opportunity. For instance, knowing when a 30-month stay is initiated allows a printing company to immediately engage both the brand and generic parties with tailored service offerings.

Furthermore, robust competitive intelligence, derived from continuously monitoring competitor filings, patent challenges, and market moves, is vital.27 This intelligence helps printing companies refine their messaging and positioning strategies, ensuring their proposals are differentiated and compelling.7 By understanding the competitive landscape, a printing company can highlight its unique strengths, such as rapid turnaround times or specialized compliance expertise, in response to specific market shifts. This ensures that the printing company is not just reacting to events but strategically positioning itself to be the preferred partner for complex pharmaceutical printing needs.

6. Strategic Trigger-Based Marketing for Pharmaceutical Printing Companies

Leveraging drug patent litigation as a trigger for marketing requires a dual-pronged approach, specifically tailored to the distinct needs of brand-name and generic pharmaceutical companies. Each litigation event presents unique opportunities for printing service providers.

Targeting Brand-Name Pharmaceutical Companies

When a brand-name drug faces a Paragraph IV (PIV) challenge from a generic manufacturer, it triggers a critical need for strategic responses from the brand company. This period, especially if a 30-month stay on generic approval is initiated, provides a valuable window for the brand to reinforce its market position and extend its product lifecycle.12

Opportunities during Patent Defense and Lifecycle Extension:

Brand companies frequently pursue “evergreening” strategies to extend market exclusivity beyond the initial patent term.17 This involves filing secondary patents that cover improvements, alternative uses, or new formulations of the original drug, such as extended-release versions, different dosage forms, or injectable forms of an oral compound.17 Each of these innovations directly necessitates new or updated package inserts, labels, and patient education materials to reflect the changes and secure FDA approval.1 This proactive strategy by brand companies to continuously innovate and secure additional patents creates a continuous, high-value stream of work for pharmaceutical printing companies, extending beyond the initial drug launch. Printing companies should actively monitor supplemental New Drug Application (sNDA) filings and patent applications for these “secondary” innovations, as they represent ongoing opportunities for significant printing projects.

Furthermore, with increased generic competition looming, brand companies may seek to enhance product security and anti-counterfeiting measures. Printing companies can proactively offer advanced security printing solutions, including RFID labeling for tracking, microtext for authentication, and various tamper-proof features, to protect brand integrity and ensure supply chain security.2 As brand companies navigate patent defense and potential new applications, there is a continuous need for compliant regulatory documentation and labeling updates.5 Printing companies can position themselves as experts in FDA-compliant printing for these complex submissions, ensuring accuracy and adherence to evolving regulations.

Proactive Engagement for Brand Protection and Market Differentiation:

To effectively engage brand-name pharmaceutical companies, printing providers should offer thought leadership content, such as webinars or whitepapers, on topics like “Maximizing Patent Lifecycles Through Strategic Filing” 17 or “Protecting Intellectual Property through Enhanced Packaging Security.” They can highlight how their printing services support brand differentiation through premium packaging designs, customized patient kits that enhance patient satisfaction and compliance 1, and innovative packaging for new drug delivery systems.36 This positions the printing company as a strategic partner invested in the brand’s long-term success and market leadership.

Targeting Generic Pharmaceutical Companies

Generic pharmaceutical companies operate under intense pressure to launch their products quickly and cost-effectively once patent barriers are removed. Patent litigation events, particularly the 30-month stay and the 180-day exclusivity period, create specific windows of opportunity and urgent needs for printing services.

Opportunities during ANDA Submission and Pre-Launch:

During the Abbreviated New Drug Application (ANDA) submission process, generic companies must prepare labeling that is “the same as” the Reference Listed Drug (RLD) labeling, with only permissible differences.35 Printing companies can assist with the creation of draft labeling, mock-ups, and other essential documentation required for ANDA submissions.38 While not direct printing, the preparation for bioequivalence studies, a critical step in ANDA approval, may involve printed protocols, patient information sheets, or sample labels for test batches.37 During the 30-month stay or the pre-launch phase, generic companies will be finalizing their packaging designs. Printing companies can offer rapid prototyping and small-run digital printing for initial samples and testing, allowing generic manufacturers to iterate quickly and prepare for mass production.3

Opportunities During and After PIV Litigation:

Once a court decision allows generic entry or a settlement agreement is reached, there is an urgent need for final, FDA-approved labeling and packaging. Printing companies offering “fast turnaround” 16 and the ability to “speed up your time to market” 2 become indispensable partners. The 180-day exclusivity period granted to the first generic entrant is a critical, time-limited window to capture significant market share and maximize revenue before other generics enter the market.12 Any delay in packaging and labeling directly erodes the generic company’s financial advantage during this exclusive period. Therefore, a printing company’s proven ability to offer rapid turnaround times and guarantee “never a missed deadline” 1 becomes an absolute necessity for the generic manufacturer. This positions the printing company not just as a service provider but as a crucial enabler of the generic client’s competitive strategy and profitability during this exclusive period.

Furthermore, successful generic launches require robust supply chain planning.33 Printing companies can integrate their services by offering comprehensive inventory management, delivery, and tracking solutions 2 to ensure product availability on pharmacy shelves the moment approval is granted.33 This holistic support helps generic companies navigate the complexities of market entry and capitalize on their competitive windows.

Effective B2B Marketing Tactics

To effectively reach and engage pharmaceutical clients based on these litigation triggers, printing companies should employ a mix of targeted B2B marketing tactics.

Content Marketing: Developing evidence-based content that resonates with decision-makers is crucial.9 This can include whitepapers on navigating FDA labeling requirements for generic launches 35 or best practices for brand security in packaging.2 Case studies showcasing rapid turnaround times for product launches 1 or successful management of complex artwork changes 15 can build credibility. Hosting webinars on topics such as “Streamlining Artwork Approval Processes for Faster Time-to-Market” 15 or “Leveraging RFID for Pharmaceutical Supply Chain Traceability” 3 positions the printing company as a thought leader.

Digital Marketing: Leveraging platforms like LinkedIn for thought leadership and stakeholder engagement is highly effective in the B2B pharma space.7 Targeted email campaigns, initiated immediately upon identification of a litigation trigger, can deliver personalized messages directly to key decision-makers.6 Search engine optimization (SEO) for relevant keywords (e.g., “ANDA labeling services,” “pharmaceutical launch kits,” “Hatch-Waxman printing solutions”) can enhance online visibility and attract inbound leads.7 Furthermore, utilizing AI-driven tools for personalized messaging and lead scoring can optimize outreach efforts and improve engagement.29

Personalized Outreach and Relationship Building: Direct, personalized outreach to key decision-makers within pharmaceutical companies—such as Regulatory Affairs, Supply Chain, and Brand Managers—is essential, especially when triggered by specific litigation events.6 Attending industry events and conferences facilitates networking and knowledge sharing, allowing for face-to-face relationship building.9 The printing company should consistently position itself as a “trusted partner” 1 that possesses a deep understanding of the unique challenges and complex regulatory landscape of the pharmaceutical industry.2 This emphasis on compliance expertise is a significant marketing differentiator. The pharmaceutical industry is “highly regulated” 7, with strict guidelines from bodies like the FDA and EMA.9 Non-compliance can result in “costly delays, product recalls, or legal penalties”.15 Therefore, for pharmaceutical printing companies, their marketing message should extend beyond their technical printing capabilities to highlight their profound understanding and proven track record in navigating this complex regulatory environment. Emphasizing their compliance expertise, such as stating “We know Pharma Labels” 2 or highlighting “HIPAA Compliant Printing” 3, builds immense trust and credibility 9, positioning them as a risk-mitigating partner rather than just a service provider. This is a critical differentiator in a market where regulatory adherence is paramount.

Table 3: Trigger-Based Marketing Opportunities for Pharmaceutical Printing Companies (Brand vs. Generic)

| Litigation Trigger Event | Affected Client Type | Client Need/Pain Point | Targeted Printing Services | Key Marketing Message/Call to Action |

| PIV Certification Filed | Generic Pharma | Preparing ANDA submission, anticipating brand response. | Draft labeling, mock-ups, regulatory documentation support. | “Streamline your ANDA submission with compliant draft labeling.” |

| 30-Month Stay Initiated | Brand-Name Pharma | Maximizing exclusivity, preparing for future competition. | New formulation PIs/labels, enhanced security features, patient program materials. | “Extend your brand’s lifecycle: Innovate and secure with our compliant printing solutions.” |

| 30-Month Stay Initiated | Generic Pharma | Finalizing launch materials, preparing for market entry. | Finalizing “same-as” labeling, packaging prototypes, pre-launch kit planning. | “Optimize your 30-month window: Get launch-ready with rapid prototyping and compliant packaging.” |

| Court Decision for Generic (Invalid/Non-Infringed) | Generic Pharma | Urgent need for immediate market launch. | Rapid production of final, approved labeling and packaging; expedited launch kits. | “Accelerate your generic launch: We deliver compliant materials at market speed.” |

| 180-Day Exclusivity Granted | Generic Pharma | Capitalizing on limited market window, maximizing market share. | Urgent, high-volume production of launch kits, sales aids, patient materials. | “Dominate the 180-day window: Our speed ensures you capture maximum market share.” |

| Patent Expiry (No Litigation/Litigation Concluded) | Generic Pharma | Preparing for broad market entry, competitive pricing. | High-volume production of standard generic packaging and labeling. | “Seamless market entry: Reliable, cost-effective printing for your generic launch.” |

This table provides a clear, actionable roadmap for marketing and sales teams, outlining specific triggers, the client type affected, and tailored service offerings and marketing messages. It directly connects legal intelligence to revenue-generating activities.

7. Operational Readiness: Ensuring Printing Agility and Compliance

To fully capitalize on trigger-based marketing opportunities, pharmaceutical printing companies must not only understand the legal landscape but also ensure their internal operations are optimized for agility, compliance, and rapid response.

Optimizing Production Workflows for Rapid Response

The pharmaceutical industry’s “fast-paced environment” 1 and “tight deadlines” 1 demand highly optimized production workflows from printing partners. This necessitates significant investment in capabilities such as digital printing, which allows for small, fast runs and rapid prototyping, crucial for quick adjustments and approvals.3 Implementing automated systems throughout the production process can significantly enhance efficiency, reduce manual errors, and ensure consistent quality.28

Furthermore, streamlining processes, integrating various operational stages, and fostering seamless collaboration across departments are essential to eliminate unnecessary steps and bottlenecks, which are critical for timely delivery.4 A printing company that can demonstrate a lean, automated, and integrated workflow is better positioned to meet the urgent demands of pharmaceutical clients, particularly during time-sensitive generic launches or brand lifecycle extensions.

Navigating Complex Artwork Approval and Change Control Processes

Pharmaceutical artwork approval is a “critical yet often complex stage” due to the stringent regulatory requirements imposed by agencies like the FDA and EMA.15 This process is fraught with challenges, including inefficiencies stemming from traditional, manual methods (e.g., emails, paper-based reviews), significant cross-functional communication barriers, and difficulties with version control.15 These issues can lead to “costly delays, product recalls, or legal penalties”.15

A pharmaceutical printing company that can demonstrate not just how they print but how they manage the artwork approval process offers a significant value-add. This capability directly addresses a major pain point for pharma clients, reducing their internal burden, mitigating compliance risks, and ultimately speeding up their time-to-market. Best practices for managing this complexity include establishing clear, well-defined artwork approval workflows with standardized roles and responsibilities.15 Improving communication and collaboration through cloud-based tools enables real-time changes and feedback, preventing miscommunication and overlaps.15 Implementing robust version control and change management protocols, including detailed audit trails and clear labeling of updated artwork with version numbers and effective dates, is crucial to prevent outdated artwork from being mistakenly approved.15 Every artwork cycle should ideally begin with a formal request and an initial quality review to assess its impact on patient safety and compliance before proceeding.44 By mastering these internal processes, printing companies can position themselves as process innovators and strategic partners in regulatory compliance.

Supply Chain Planning and Inventory Management for Just-in-Time Delivery

A robust and agile supply chain is critical for successful pharmaceutical product launches, especially for generic drugs where speed to market is paramount.33 Pharmaceutical printing companies can significantly enhance their value proposition by offering comprehensive inventory management services, ensuring that necessary materials are available precisely when needed, minimizing delays.2

Understanding and meticulously managing lead times for all packaging components is crucial to avoid bottlenecks. Lead time, defined as the duration from the start of a process to its conclusion, can vary significantly for packaging components based on factors such as complexity, volume, customization, material availability, and the regulatory approval process itself.45 For instance, labels might have a 7-14 day lead time, while cartons could take 1-4 weeks, and inserts 3-4 weeks, depending on the manufacturer’s location and specific requirements.16 Generic drug launches are highly time-sensitive, often driven by the competitive 180-day exclusivity windows.12 Delays in packaging and labeling directly impact market entry and revenue capture. The FDA’s own approval times for ANDAs can range from 10-18 months, highlighting the extended periods of preparation and the need for precision in timing.33 Therefore, a printing company’s ability to minimize and reliably predict packaging and labeling lead times directly contributes to a pharma company’s ability to hit critical launch dates and maximize the value of exclusivity periods. By offering “fast turnaround” 16 and efficient supply chain management 2, the printing company becomes an integral part of the client’s time-to-market strategy, helping them “nail the approval process to hit the ground running”.33 This transforms lead time from a mere logistical challenge into a key competitive differentiator that should be prominently highlighted in marketing efforts.

Table 4: Typical Lead Times for Pharmaceutical Packaging & Labeling Components

| Component Type | Typical Lead Time Range (Weeks/Days) | Factors Influencing Lead Time | Printing Company’s Advantage |

| Labels (Standard) | 7-14 days 16 | Volume, complexity, material type, digital vs. flexo printing. | Guaranteed fast turnaround, 200% inspection for zero defects.16 |

| Labels (Complex/Security) | 2-4 weeks (local) 46 | Custom features (RFID, microtext, braille), specialized materials, multiple layers. | Expertise in advanced security printing, low-migration adhesives/inks.3 |

| Cartons/Boxes | 1-4 weeks (local) 46 | Design complexity, material stock, finishing techniques, volume. | Streamlined artwork approval, efficient production workflows.15 |

| Package Inserts (PIs)/Booklets | 3-4 weeks (local) 46 | Content volume, number of folds, binding, regulatory review cycles. | Expertise in FDA-compliant content, precise folding/finishing for complex PIs.1 |

| Shrink Sleeves | 3-6 weeks (local) 46 | Artwork complexity, material type, application method compatibility. | Specialized printing capabilities, adherence to FDA-approved specifications.2 |

| Customized Patient Kits | Varies widely (often 6-12 weeks) 1 | Number of components, assembly complexity, custom packaging elements, sourcing. | Comprehensive program management, kit assembly, on-time delivery coordination.1 |

This table provides practical, transparent information for potential clients, helping them understand the timelines involved in pharmaceutical packaging and labeling. It also demonstrates the printing company’s expertise in managing these critical operational aspects, setting realistic expectations and highlighting the value of a partner who can optimize these timelines.

8. Conclusion and Actionable Recommendations

Summary of the Strategic Advantage

Integrating legal intelligence into marketing strategies offers pharmaceutical printing companies a profound strategic advantage. By proactively monitoring drug patent litigation events, these companies can anticipate the distinct and urgent needs of both brand-name and generic pharmaceutical clients. This foresight enables them to offer highly relevant, timely, and specialized services, transforming their role from mere vendors to indispensable strategic partners. The ability to support brand lifecycle extension through new formulations and enhanced security, while simultaneously facilitating rapid generic market entry with expedited launch materials and compliant packaging, positions printing companies at the nexus of pharmaceutical innovation and market dynamics. This strategic alignment unlocks new revenue streams and deepens client relationships, fostering long-term partnerships built on trust and demonstrated value.

Key Recommendations for Implementation

To successfully leverage drug patent litigation for trigger-based marketing, pharmaceutical printing companies should consider the following actionable recommendations:

- Invest in Legal Intelligence Platforms: Subscribe to specialized services, such as IPD Analytics or other patent monitoring tools, to gain real-time, actionable insights into patent litigation events, loss-of-exclusivity timings, and drug launch forecasts.26 This investment is foundational for identifying triggers.

- Develop Cross-Functional Teams: Foster seamless collaboration between marketing, sales, operations, and quality/regulatory teams. This ensures that legal triggers are effectively interpreted and translated into actionable service offerings and tailored marketing campaigns, bridging the gap between legal intelligence and business execution.15

- Create Tailored Service Packages: Design specific service bundles that cater to the unique needs arising from patent litigation. For brand companies, this might include packages focused on lifecycle extension (e.g., new formulation labeling, enhanced security features). For generic companies, focus on rapid launch solutions (e.g., 180-day exclusivity kits, “same-as” labeling, expedited production, and supply chain integration).1

- Emphasize Compliance and Speed in Marketing: Continuously highlight the company’s deep regulatory expertise (FDA, HIPAA, cGMP) and its proven ability to meet tight deadlines and navigate complex artwork approval processes. This builds immense trust and credibility, positioning the company as a risk-mitigating and speed-enabling partner.1

- Leverage Content Marketing Strategically: Produce educational content, such as whitepapers, webinars, and case studies, that directly addresses the specific pain points and opportunities arising from patent litigation for both brand and generic clients. This establishes the printing company as a knowledgeable authority in the pharmaceutical landscape.9

- Implement CRM for Trigger Tracking and Automated Outreach: Integrate legal intelligence alerts directly into CRM systems. This enables automated, personalized outreach to pharmaceutical clients based on specific litigation milestones, ensuring timely and relevant communication.29

- Optimize Internal Workflows Continuously: Invest in and continuously refine production, artwork approval, and supply chain processes. This includes adopting digital printing, automation, and robust change control systems to ensure maximum agility, compliance, and the ability to deliver on the promise of rapid, accurate production.15

Future Outlook for the Pharmaceutical Printing Market

The pharmaceutical market is in a constant state of evolution, driven by factors such as the significant growth of the generic market, projected to reach $916.2 billion by 2033.49 This expansion is fueled by the expiration of blockbuster drug patents and increasing demand for affordable healthcare solutions.22 The rising complexity of biologics and biosimilars, along with the adoption of advanced manufacturing technologies like continuous production, will further shape the industry.50 Emerging trends, including the integration of artificial intelligence in supply chain management and the shift towards personalized medicine requiring smaller batch production, will continue to transform the landscape.33 In this dynamic environment, the demand for agile, compliant, and technologically adept pharmaceutical printing partners will only intensify. Companies that proactively adapt their strategies, leveraging legal intelligence to anticipate and meet these evolving needs, will be best positioned for sustained success and market leadership.

Works cited

- Pharmaceutical Printing Company – Graphic Solutions Group, accessed May 27, 2025, https://www.gsghome.com/markets/pharmaceutical/

- Pharmaceutical Printing and Inventory – RLG Healthcare – Resource Label Group, accessed May 27, 2025, https://www.resourcelabel.com/healthcare/pharmaceutical/

- Pharmaceutical – SunDance USA, accessed May 27, 2025, https://sundanceusa.com/industries/food-drug/pharma/

- Pharmaceutical Printing – Heeter, accessed May 27, 2025, https://www.heeter.com/industries/pharmaceutical-printing/

- Pharma Suite of Services | LexisNexis Reed Tech, accessed May 27, 2025, https://www.reedtech.com/pharma-suite-of-services/

- How To Use Trigger Events in B2B Sales – SyncMatters, accessed May 27, 2025, https://syncmatters.com/blog/how-to-use-trigger-events-in-b2b-sales

- B2B Marketing Strategies for Success in the Pharmaceutical Sector, accessed May 27, 2025, https://altitudemarketing.com/blog/b2b-marketing-strategies/

- Will pharmaceutical tariffs achieve their goals? – Brookings Institution, accessed May 27, 2025, https://www.brookings.edu/articles/pharmaceutical-tariffs-how-they-play-out/

- B2B Pharma Marketing Best Practices for Maximizing Impact – Fishbat, accessed May 27, 2025, https://fishbat.com/b2b-pharma-marketing-best-practices/

- Drug Pricing and the Law: Pharmaceutical Patent Disputes …, accessed May 27, 2025, https://www.congress.gov/crs-product/IF11214

- The Role of Patents and Regulatory Exclusivities in Drug Pricing | Congress.gov, accessed May 27, 2025, https://www.congress.gov/crs-product/R46679

- How Patent Litigation Influences Drug Approvals and Market Entry, accessed May 27, 2025, https://patentpc.com/blog/how-patent-litigation-influences-drug-approvals-and-market-entry/

- Tax Victory for Generic Drug Companies: Federal Circuit Affirms ANDA Litigation Expenses are Deductible | Patently-O, accessed May 27, 2025, https://patentlyo.com/patent/2025/03/companies-litigation-deductible.html

- Navigating FDA Guidelines for Pharmaceutical Packaging: A Focus on Packaging Artwork, accessed May 27, 2025, https://www.schlafenderhase.com/shblog/navigating-fda-guidelines-pharmaceutical-packaging-artwork

- How to Streamline Your Artwork Approval Process | kallik-new, accessed May 27, 2025, https://www.kallik.com/resources/blog/streamline-artwork-approval-processes

- Chemical & Pharmaceutical Label Printing – TrueLabel, accessed May 27, 2025, https://truelabel.com/

- How Patent Law Affects the Pharmaceutical Industry Under U.S. Health Laws – PatentPC, accessed May 27, 2025, https://patentpc.com/blog/how-patent-law-affects-the-pharmaceutical-industry-under-u-s-health-laws

- Patent Litigation in the Pharmaceutical Industry: Key Considerations, accessed May 27, 2025, https://patentpc.com/blog/patent-litigation-in-the-pharmaceutical-industry-key-considerations

- Patent Considerations for Drug Manufacturing Processes – PatentPC, accessed May 27, 2025, https://patentpc.com/blog/patent-consideration-drug-manufacturing-processes

- www.curtis.com, accessed May 27, 2025, https://www.curtis.com/glossary/intellectual-property/hatch-waxman-act#:~:text=The%20Hatch%20Waxman%20Act’s%20period,allowed%20to%20come%20to%20market.

- Hatch-Waxman Letters – FDA, accessed May 27, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/hatch-waxman-letters

- Drug Competition Series – Analysis of New Generic Markets Effect of Market Entry on Generic Drug Prices, accessed May 27, 2025, https://aspe.hhs.gov/sites/default/files/documents/510e964dc7b7f00763a7f8a1dbc5ae7b/aspe-ib-generic-drugs-competition.pdf

- U.S. Insights: Paragraph IV Litigation Decision Trends for Top 20 Generic Manufacturers, 2017–2023 – IPD Analytics, accessed May 27, 2025, https://www.ipdanalytics.com/sample-reports-1/u.s.-insights%3A-paragraph-iv-litigation-decision-trends-for-top-20-generic-manufacturers%2C-2017%E2%80%932023

- Patent Certifications and Suitability Petitions | FDA, accessed May 27, 2025, https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions

- How long is the patent on a new drug before generic brands are made available?, accessed May 27, 2025, https://synapse.patsnap.com/article/how-long-is-the-patent-on-a-new-drug-before-generic-brands-are-made-available

- IPD Analytics | The Industry Leader in Drug Life-Cycle Insights, accessed May 27, 2025, https://www.ipdanalytics.com/

- Enjoy Quality Patent Monitoring and Protection Services – PatentPC, accessed May 27, 2025, https://patentpc.com/blog/enjoy-quality-patent-monitoring-and-protection-services

- Top Tools for Patent Portfolio Management in 2024 – PatentPC, accessed May 27, 2025, https://patentpc.com/blog/top-tools-for-patent-portfolio-management-in-2024

- How is legal tech marketing changing how firms operate?, accessed May 27, 2025, https://www.onelegal.com/blog/how-is-legal-tech-marketing-changing-how-firms-operate/

- Law Firm Predictive Analytics: Use Cases And Applications – Clio, accessed May 27, 2025, https://www.clio.com/blog/law-firm-predictive-analytics/

- AI in Legal Marketing: How Technology is Transforming Client Acquisition, accessed May 27, 2025, https://sanguinesa.com/ai-in-legal-marketing-how-technology-is-transforming-client-acquisition/

- ChatGPT for Legal Marketing: 6 Ways to Unlock the Power of AI – CASEpeer, accessed May 27, 2025, https://www.casepeer.com/blog/chatgpt-for-legal-marketing

- How to Implement a Successful Generic Drug Launch Strategy – DrugPatentWatch – Transform Data into Market Domination, accessed May 27, 2025, https://www.drugpatentwatch.com/blog/how-to-implement-a-successful-generic-drug-launch-strategy/

- Clearing the Path for New Uses for Generic Drugs – Federation of American Scientists, accessed May 27, 2025, https://fas.org/publication/clearing-the-path-for-new-uses-for-generic-drugs/

- Generic Drugs – Specific Labeling Resources – FDA, accessed May 27, 2025, https://www.fda.gov/drugs/fdas-labeling-resources-human-prescription-drugs/generic-drugs-specific-labeling-resources

- Patent Considerations for Novel Drug Delivery Systems – PatentPC, accessed May 27, 2025, https://patentpc.com/blog/patent-consideration-for-novel-drug-delivery-system

- What is a generic drug, and how does it get approved? – Patsnap Synapse, accessed May 27, 2025, https://synapse.patsnap.com/article/what-is-a-generic-drug-and-how-does-it-get-approved

- Understanding the Lifecycle of Generic Drugs: From Development to Market Impact, accessed May 27, 2025, https://www.drugpatentwatch.com/blog/understanding-the-lifecycle-of-generic-drugs-from-development-to-market-impact/

- The ANDA Process: A Guide to FDA Submission & Approval – Excedr, accessed May 27, 2025, https://www.excedr.com/blog/what-is-abbreviated-new-drug-application

- Artwork Change Control Management in the Pharma Industry, accessed May 27, 2025, https://zamann-pharma.com/2025/02/24/artwork-change-control-management-in-the-pharma-industry/

- B2B Healthcare Marketing in 2025: Strategies, Tools, Compliance & Case Studies for Success, accessed May 27, 2025, https://www.b2b-marketing.org/b2b-healthcare-marketing-in-2025-strategies-tools-compliance-case-studies-for-success/

- QbD Group: Your Trusted Partner for Life Sciences Consulting, accessed May 27, 2025, https://www.qbdgroup.com/en/

- Why Streamlining Your Artwork Approval Process Is Non-Negotiable – ManageArtworks, accessed May 27, 2025, https://www.manageartworks.com/blog-post/why-your-packaging-workflow-needs-a-smart-artwork-approval-process

- Importance of Pharmaceutical Artwork Management in 2025 – Signify, accessed May 27, 2025, https://www.getsignify.com/blog/pharmaceutical-artwork-management

- Lead Time: Definition, How It Works, and Example – Investopedia, accessed May 27, 2025, https://www.investopedia.com/terms/l/leadtime.asp

- Packaging Lead Time – Time May Not Be On Your Side, accessed May 27, 2025, https://www.howtobuypackaging.com/packaging-lead-time/

- Processing Times for Label Applications | TTB: Alcohol and Tobacco Tax and Trade Bureau, accessed May 27, 2025, https://www.ttb.gov/regulated-commodities/labeling/processing-times

- The Generic Drug Approval Process – FDA, accessed May 27, 2025, https://www.fda.gov/drugs/cder-conversations/generic-drug-approval-process

- Generic Pharmaceuticals Market Opportunities and Strategy Report 2024-2033 Featuring Key Players – Teva Pharmaceutical, Sandoz, Sun Pharmaceutical, Viatris, and Abbott Laboratories – ResearchAndMarkets.com – Business Wire, accessed May 27, 2025, https://www.businesswire.com/news/home/20250509243503/en/Generic-Pharmaceuticals-Market-Opportunities-and-Strategy-Report-2024-2033-Featuring-Key-Players—Teva-Pharmaceutical-Sandoz-Sun-Pharmaceutical-Viatris-and-Abbott-Laboratories—ResearchAndMarkets.com

- Generic Pharmaceuticals Contract Manufacturing Market to Surpass Valuation of US$ 135.43 Billion By 2033 | Astute Analytica – GlobeNewswire, accessed May 27, 2025, https://www.globenewswire.com/news-release/2025/02/21/3030487/0/en/Generic-Pharmaceuticals-Contract-Manufacturing-Market-to-Surpass-Valuation-of-US-135-43-Billion-By-2033-Astute-Analytica.html