I. Introduction: The Looming Pharmaceutical Patent Cliff

The pharmaceutical industry stands at the precipice of an unprecedented challenge, often described as a “tectonic shift”.1 This period, widely known as the “patent cliff,” is far from a temporary market fluctuation; it represents a fundamental reshaping of the industry landscape as crucial intellectual property protections for blockbuster drugs expire.

Setting the Stage: The “Tectonic Shift” in Pharma

The pharmaceutical sector is currently “hurtling toward 2030’s multibillion-dollar patent cliff”.3 This impending wave of patent expirations is projected to put “more than $200 billion in annual revenue at risk through 2030”.1 By 2030, the industry faces a staggering “$236 billion patent cliff,” with nearly 70 high-revenue products exposed to competition.4 Blockbuster medications such as Eliquis, Keytruda, and Stelara, which collectively generate over $48 billion in global sales, are among those slated to lose exclusivity.3

While the term “cliff” aptly describes the steep drop in revenue that often follows, the approaching nature of this event is predictable, not sudden. This foreseeability provides companies with a critical window for proactive strategic intervention, shifting the focus from reactive damage control to deliberate, forward-looking preparation. The urgency lies in the preparedness for this known event, compelling organizations to adapt their core business models.

Defining the Patent Cliff: A Steep Drop in Revenue

A patent cliff occurs when the intellectual property (IP) protection for a drug expires, opening the market to increased competition from generic and biosimilar alternatives.3 This phenomenon typically results in a “sharp decline in revenues” for the original manufacturer. For small molecule drugs, this can lead to a market share reduction of “80% or more for the branded drug within the first year”.1 For instance, when Humira lost patent protection in 2023, it marked the end of a two-decade monopoly that had generated over $200 billion in total revenue.3

Intellectual property protection, while crucial for recouping significant research and development (R&D) investments, presents a dual challenge. While it grants exclusive rights that incentivize innovation, its eventual expiration forces a critical re-evaluation of market strategies. The core challenge for pharmaceutical companies is not merely to protect existing IP, but to sustain innovation momentum and market value beyond the period of patent exclusivity.3 This necessitates a continuous cycle of innovation and strategic renewal, moving beyond reliance on isolated blockbuster drug development.

The Scale of the Challenge: Billions at Risk by 2030

The magnitude of the impending patent cliff is substantial. Key therapeutic areas such as oncology, which currently accounts for 22% of global drug revenue and is projected to reach 27% by 2030, will experience intensified competition as drugs like Merck’s Keytruda ($25 billion in 2023 sales, expiring 2028) and Bristol-Myers Squibb’s Eliquis ($12 billion, expiring 2027 or 2028) lose their patents.4 By 2026, it is estimated that eight of the thirteen largest pharmaceutical firms, representing 55% of global market value, could see 30% or more of their revenue jeopardized, with potential losses ranging from $6 billion to $38 billion per company.4

The global dimension of patent cliffs further complicates management strategies, as patent protection expires at different times across various jurisdictions.3 This necessitates a nuanced, regionally tailored approach to product lifecycle management and market expansion, rather than a uniform, one-size-fits-all strategy. Companies must navigate diverse regulatory environments and competitive landscapes in each market.

II. Navigating the Cliff: Traditional Strategies and Their Limits

Pharmaceutical companies have historically employed various strategies to mitigate the impact of patent expirations. However, the current landscape reveals significant limitations to these traditional approaches, underscoring the urgent need for more adaptive and innovative solutions.

R&D and Pipeline Development: The Long Game

Traditionally, pharmaceutical companies have sought to offset revenue losses by developing new blockbuster drugs to replenish their portfolios.6 This approach demands “substantial R&D investment” to cultivate a “robust pipeline of innovations”.3 However, the industry is grappling with a profound R&D productivity crisis. R&D margins are projected to decline significantly, from 29% of total revenue to 21% by the end of the decade.7 The commercial performance of new drug launches is shrinking, and success rates for Phase 1 drugs have plummeted to just 6.7% in 2024, down from 10% a decade ago.7 This diminishing return on R&D investment means that relying solely on the discovery of new blockbusters to replace lost revenue is becoming increasingly difficult and expensive, exacerbating the patent cliff problem.6

Mergers, Acquisitions, and Cost-Cutting: Immediate Responses

In response to previous patent cliffs, the industry often saw “increasing consolidation” through megamergers, such as Pfizer’s acquisition of Wyeth or Merck’s integration with Schering-Plough.1 This strategy aimed to immediately bolster revenue streams and diversify portfolios. However, this approach is showing diminishing returns. After years of extensive industry consolidation, “there are not many major large drugmakers left as attractive merger targets. Those that remain have patent cliffs of their own”.1 This suggests that M&A is a less viable long-term solution, highlighting the urgent need for internal innovation and operational efficiency to drive sustainable growth.

In the face of impending patent expirations, some companies are also resorting to more immediate, reactive measures. For example, Bristol Myers Squibb has implemented “cost-cuts” and layoffs, aiming to save up to $1.5 billion through 2025, as a means to weather the storm.8 While such measures can provide short-term financial relief, they do not address the fundamental need for sustainable innovation and market adaptation. Furthermore, some companies, like Novartis, have employed regulatory maneuvering, filing citizen petitions with the FDA to delay generic approvals, a tactic to buy time rather than foster long-term growth.8

The Need for Operational Innovation Beyond the Lab

The prevailing sentiment within the industry is that “it is not enough to counter the patent cliff simply through the development of new drugs”.2 To effectively navigate this challenging period, pharmaceutical companies must also “accelerate time-to-market while maintaining compliance and cutting costs” through comprehensive “reorganization and operational efficiency”.2 This shift in focus emphasizes that innovation must extend beyond the laboratory to encompass every aspect of the value chain, particularly manufacturing, logistics, and packaging.

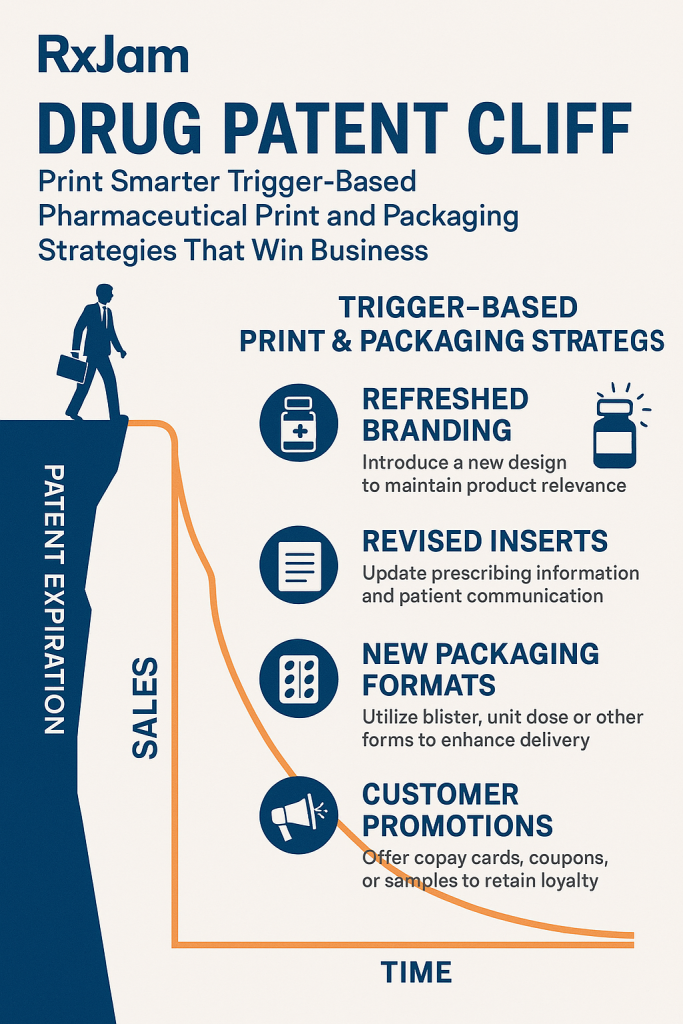

III. Print Smarter: The Rise of Trigger-Based Pharmaceutical Packaging

In this evolving landscape, pharmaceutical packaging is emerging as a critical strategic asset, moving beyond its traditional role to become a dynamic enabler of business resilience and growth.

Understanding “Trigger-Based” in Pharma Packaging: Responsiveness and Adaptability

“Trigger-based” pharmaceutical print and packaging strategies refer to dynamic, responsive approaches that adapt rapidly to market changes, regulatory updates, and specific product or patient needs. This paradigm contrasts sharply with static, high-volume pre-printing, allowing for unparalleled flexibility and precision. The patent cliff, while a significant threat, is compelling companies to embrace digital solutions and rethink traditional workflows.2 This pressure is accelerating necessary digital transformation that yields broader, long-term strategic benefits beyond just mitigating immediate revenue loss. It transforms the crisis into an opportunity for fundamental organizational evolution.

Why Packaging is Now a Strategic Imperative

Pharmaceutical packaging has undergone a profound transformation, evolving from a “simple protective shell into a sophisticated tool for safety, adherence, and anti-counterfeiting”.9 It is now considered “equally crucial” to drug formulation, playing a vital role in ensuring product stability, preventing contamination, facilitating correct usage, and deterring illicit activities like counterfeiting.9 This elevated status means that the industry now views packaging as a “frontline technology” 9 that directly contributes to patient safety, adherence, and overall health outcomes. This recognition motivates substantial investment in innovative packaging solutions, positioning them as a core component of healthcare delivery and a key driver of patient trust and brand loyalty.

IV. Pillars of Smart Pharmaceutical Packaging: Innovation in Action

The shift towards responsive, adaptive packaging is supported by several key technological advancements and strategic approaches, collectively forming the foundation of smart pharmaceutical packaging.

A. Variable Data Printing: Precision and Personalization in a Dynamic Market

Variable Data Printing (VDP) is a digital printing technique that allows for the dynamic customization of elements such as text, images, barcodes, and QR codes on each individual printed product.10 This is achieved by using data inputs from a database, enabling unique information on every label within a single printing cycle.11

Benefits: Serialization, Personalization, Regulatory Compliance, Cost-Efficiency

- Serialization and Traceability: VDP facilitates unique barcoding and serialization 10, which are essential for tracking products throughout the supply chain and complying with regulatory mandates such as the Drug Supply Chain Security Act (DSCSA) in the United States and the Falsified Medicines Directive (FMD) in the European Union.11 This capability is instrumental in combating counterfeiting and streamlining targeted product recalls.9

- Patient-Specific Information: A significant advantage of VDP is its ability to seamlessly incorporate patient-specific details, including name, prescriber, and precise dosing instructions, directly onto medication labels.11 This personalization dramatically improves patient safety and enhances adherence to medication regimens, leading to better health outcomes. This direct link to patient well-being is a powerful means to maintain brand value and customer relationships, even when facing generic competition.

- Regulatory Compliance: VDP enables rapid adaptation to evolving regulatory requirements, ensuring continuous compliance without the need to reprint entire stocks of labels.11 This flexibility reduces waste and significantly improves operational efficiency.

- Cost-Effectiveness and Efficiency: VDP supports on-demand customization, eliminating the need for multiple print runs and substantially reducing storage costs associated with pre-printed labels.10 It facilitates “just-in-time labeling,” which minimizes waste, especially when regulations change, and lowers inventory costs.11 The capability to produce “high-mix/low to medium-volume quantities” with “no minimum order quantities (MOQ’s)” 12 signifies a strategic shift towards mass customization in pharmaceutical packaging. This allows companies to respond to diverse market needs, such as patient-specific dosing, regional variations, or clinical trial requirements, with unparalleled agility and cost-effectiveness, moving away from the inefficiencies of large, static print runs.

B. Intelligent Packaging: Enhancing Safety, Adherence, and Traceability

Intelligent packaging solutions are transforming how pharmaceutical products interact with patients and the supply chain, providing critical layers of safety, adherence, and authentication.

Electronic Labels and Patient Adherence: Beyond the Pill Bottle

Smart packaging systems, including electronic labels, can track medication usage patterns and provide timely reminders to patients.9 These systems can even alert healthcare providers to missed doses, a feature particularly valuable for managing chronic illnesses and improving overall patient outcomes.9 While many companies currently underutilize smart packaging, often merely linking QR codes to a basic company website 14, the true potential lies in delivering richer, dynamic, and interactive content. This includes comprehensive product guides, dynamic text, and integrated loyalty programs.14 Such advanced applications foster deeper patient engagement and personalized experiences, thereby strengthening brand relationships and helping to secure market share even in the face of generic competition.

Anti-Counterfeiting Measures: RFID, QR Codes, and Tamper-Evident Solutions

The proliferation of counterfeit drugs remains a major global issue, posing severe risks to patient safety and significant financial and legal liabilities for legitimate pharmaceutical companies.13 Packaging innovations are at the forefront of defense against this illicit trade.15 A robust strategy against counterfeiting requires a multi-layered approach, combining both low-tech and high-tech solutions. This includes widely adopted tamper-evident packaging features such as breakable seals, shrink bands, and perforated closures.9 More sophisticated solutions involve forensic markers, holograms, microtext printing, invisible inks, and DNA-based identifiers, which are difficult to replicate.9 Technologies like Radio-Frequency Identification (RFID) tags and QR codes enable real-time tracking, bolstering supply chain transparency and significantly reducing the likelihood of diversion or counterfeit substitution. A simple scan of these identifiers can verify a product’s origin and authenticity, empowering both pharmacists and consumers.9

Supply Chain Transparency: Real-Time Monitoring and Blockchain Integration

Enhancing supply chain transparency is crucial for ensuring product integrity and combating counterfeiting. Technologies such as RFID tags and QR codes enable real-time tracking of products throughout the supply chain, providing critical visibility from manufacturing to the point of care.9 Time-Temperature Indicators (TTIs) are particularly crucial for maintaining cold chain integrity, especially for sensitive products like biologics and vaccines. These indicators provide a visual assurance of proper handling, reducing the risk of administering compromised medicines.9

A cutting-edge development in this area is the integration of blockchain technology. Partnerships, such as that between Gerresheimer and Merck, are exploring “digital twin” primary packaging solutions that leverage blockchain for “full traceability and digital trust”.16 This approach creates a decentralized, transparent, and immutable record of every transaction in the supply chain, significantly reducing the risk of fraud and providing end-to-end traceability and real-time verification of a product’s history.13 This not only enhances security but also opens doors for new business models through process automation 16, streamlining operations in a complex, high-volume generic market.

C. Sustainable Packaging: Meeting Regulatory Demands and Consumer Expectations

The pharmaceutical industry is under increasing pressure to adopt environmentally responsible practices, driven by growing regulatory restrictions and evolving consumer demand for eco-friendly solutions.17

The Drive for Eco-Friendly Solutions: Materials and Design

This imperative is leading to a significant transition in packaging materials and design. Companies are moving away from traditional PVC/aluminum blisters towards mono-polymer alternatives, and actively utilizing biodegradable and recyclable materials such as post-consumer recycled (PCR) plastics, bio-plastics derived from renewable resources like cellulose, cornstarch, and sugarcane, and paper-based packaging.15 Efforts are also focused on minimizing overall packaging waste through the adoption of lightweight materials, minimalist design principles, and the exploration of reusable containers.18

Balancing Sustainability with Drug Integrity and Compliance

The primary challenge in this transition is to “balance sustainability with drug protection”.15 Eco-friendly materials must meet stringent safety standards for drug stability, sterility, and child safety.15 This necessitates rigorous testing and, often, new regulatory filings for any changes to primary packaging materials.15 Despite these hurdles, sustainability initiatives, particularly those informed by Life Cycle Assessments (LCAs), can offer significant strategic advantages. Beyond their direct environmental benefits, these initiatives can lead to “enhanced efficiency of shipping and pallet design, resulting in lower storage and distribution costs”.17 This demonstrates that sustainability is not merely a corporate social responsibility (CSR) initiative but a potent strategic lever for achieving cost-efficiency, a critical factor for managing post-patent revenue decline.

V. Agile Supply Chains: The Backbone of Responsive Packaging

The effectiveness of trigger-based pharmaceutical packaging strategies is inextricably linked to the agility and responsiveness of the underlying supply chain.

The Imperative for Agility in a Volatile Market

Agile supply chain management prioritizes “flexibility, adaptability, and the capacity to react quickly to changes in supply and demand”.20 This capability is paramount for navigating the unpredictable market environments that emerge post-patent expiry and for maintaining sales momentum.21 The disruptions caused by the COVID-19 pandemic further underscored this necessity, with 75% of supply chain experts reporting modifications to their procedures.20 An agile supply chain is designed to lessen a system’s susceptibility to external influences, with the primary goal of reducing the possibility of significant disruptions.20

Strategies for an Agile Pharma Supply Chain: Data, Automation, and Partnerships

To build and sustain an agile pharmaceutical supply chain, companies are increasingly leveraging advanced technologies and strategic collaborations.

- Real-time Data and Analytics: Agile supply networks provide “precise, instantaneous insight into demand” by continuously gathering information from every link in the supply chain and applying sophisticated analytics.20 This data-driven approach enables swift adjustments to production output and inventory levels, allowing companies to respond rapidly to market shifts.20 The consistent emphasis on “real-time data,” “sophisticated analytics,” “AI,” and “cloud-based platforms” 20 highlights that these technologies constitute the fundamental infrastructure enabling an agile supply chain. Without them, true responsiveness to market triggers, such as sudden shifts in generic demand or regulatory changes, would be impossible.

- Warehouse Automation: Automating warehouse activities, including order processing, picking, packaging, and shipping, through cloud-based warehouse management systems (WMS), significantly enhances the supply chain’s ability to respond quickly to demand changes and accelerate order fulfillment.20 This automation directly contributes to operational efficiency and speed.

- Strategic Partnerships: Collaborating with Contract Packaging Organizations (CPOs) offers access to diverse packaging solutions, improves business stability, and provides crucial capacity management, enabling companies to adapt quickly without significant internal investment.21 Similarly, leveraging Third-Party Logistics (3PL) providers increases supply chain agility by outsourcing fulfillment, shipping, and warehousing, allowing businesses to scale operations efficiently without substantial capital outlay.20

Impact on Cost-Efficiency and Time-to-Market Post-Patent Expiry

Agile logistics directly contribute to cost-efficiency and accelerated time-to-market in the post-patent landscape. The use of lightweight and durable packaging that maximizes cargo space, for instance, directly reduces shipping costs.22 Real-time monitoring and advanced risk management tools provide a competitive edge and accelerate time-to-market, particularly for new products with limited stability data.22

Furthermore, agile supply chains play a critical role in mitigating the risk of “inventory obsolescence.” By enabling operations with “little stock” and the ability to “swiftly increase or decrease output” 20, these systems directly address the significant financial risk associated with holding large, expensive inventories of branded drugs that rapidly lose market share post-patent expiry.3 This is a crucial cost-saving and risk-mitigation strategy.

A significant future development impacting packaging and logistics is the increasing prevalence of medicines requiring cold storage. It is projected that “nearly half of all new medicines in the next three years” will require such conditions.22 This trend acts as a substantial future trigger for specialized packaging and logistics solutions, driving further innovation in temperature-controlled packaging and real-time monitoring systems, which are essential for maintaining product integrity and cost-efficiency in a market increasingly reliant on high-value, sensitive drugs.

VI. Winning Business Beyond Exclusivity: Strategic Integration and Competitive Advantage

The patent cliff, while presenting formidable challenges, also serves as a powerful catalyst for strategic transformation, compelling pharmaceutical companies to reimagine their business models and embrace a holistic approach to innovation.

From Threat to Opportunity: Reimagining Product Lifecycles

The patent cliff should be viewed as an “opportunity for strategic renewal” 2, compelling companies to “reinvent the current model of drug discovery and drug marketing”.6 This involves not just developing new drugs, but strategically timing new product launches to coincide with patent expirations, further developing existing drugs through new formulations, delivery systems, or expanded indications, and actively expanding into new geographic or demographic markets.3

Industry experts suggest that the sector is “potentially entering an era of fewer blockbusters and a lot more smaller products”.1 This profound shift implies that post-patent cliff strategies must focus on building a diversified portfolio of specialized therapies rather than relying on a few mega-drugs. This has far-reaching implications for R&D focus, commercialization models, and necessitates more flexible and varied packaging needs, such as smaller batches and highly tailored designs.

Integrating Packaging Innovation into Core Business Strategy

Successful patent cliff management demands “greater integration between technical innovation and market strategy”.3 Packaging, once considered a mere logistical component, is now recognized as a strategic asset that enables regulatory compliance, enhances patient experience, and actively protects revenue streams. This elevates packaging to a central role in the overall business strategy.

Furthermore, leveraging technologies and insights from other sectors, such as beauty or food, can drive innovation in pharmaceutical packaging. For instance, Aptar’s ability to apply precision injection molding and high-speed assembly across diverse industries, and the observed desire of customers to cross-pollinate technologies between sectors 25, illustrates how cross-industry innovation can be a powerful source of competitive advantage. This approach allows for economies of scale, introduces diverse perspectives, and accelerates the development of novel solutions for complex pharmaceutical packaging challenges.

The Future-Ready Pharmaceutical Company

Companies that embrace the patent cliff as an “opportunity for strategic renewal” rather than simply a challenge are best positioned to maintain market leadership.3 This requires building robust organizational capabilities for “continuous innovation, and market adaptation”.3 The future-ready pharmaceutical company will be one that leverages digital transformation, cultivates agile supply chains, and integrates smart, sustainable packaging solutions as core components of its strategy to navigate market shifts, maintain patient trust, and secure long-term business success.

VII. Key Takeaways

- The pharmaceutical industry faces a monumental patent cliff, with hundreds of billions in revenue at risk by 2030, necessitating urgent and profound strategic adaptation.

- Traditional responses like reliance on new R&D blockbusters and large-scale mergers are proving insufficient due to declining R&D productivity and limited M&A opportunities.

- “Trigger-based” packaging strategies, enabled by Variable Data Printing and Intelligent Packaging, offer dynamic solutions for critical needs such as serialization, anti-counterfeiting, patient adherence, and personalization.

- An agile supply chain, powered by real-time data, artificial intelligence, and strategic partnerships, is the indispensable backbone for implementing these responsive packaging solutions efficiently and cost-effectively, mitigating risks like inventory obsolescence.

- Sustainability in packaging is not merely an environmental mandate but a strategic lever for cost reduction and operational efficiency, driving broader innovation in materials and processes.

- The patent cliff is accelerating industry-wide digital transformation, pushing companies towards smarter manufacturing, deeper patient engagement, and a strategic focus on diversified, specialized, and high-value products rather than solely relying on blockbusters.

VIII. Frequently Asked Questions (FAQ)

What is a drug patent cliff?

A “drug patent cliff” refers to the sharp decline in revenue experienced by pharmaceutical companies when patents for their blockbuster drugs expire, opening the market to generic and biosimilar competition. This can lead to an 80% or more market share reduction for branded drugs within the first year.3

How significant is the current patent cliff for the pharmaceutical industry?

The industry is facing a “tectonic magnitude” patent cliff, with over $200 billion in annual revenue at risk through 2030. Nearly 70 high-revenue products, including Keytruda and Eliquis, are set to lose exclusivity, impacting major players like Bristol-Myers Squibb, AbbVie, and Novartis.1

What are “trigger-based” pharmaceutical print and packaging strategies?

These are dynamic, responsive approaches to packaging and printing that adapt quickly to specific market events, regulatory changes, or individual product/patient needs. They leverage technologies like variable data printing, smart packaging, and agile supply chains to provide flexibility and precision.11

How does variable data printing help pharmaceutical companies?

Variable Data Printing (VDP) allows for unique identifiers (serialization, barcodes), batch-specific information, and patient-specific instructions on each package. This enhances traceability, anti-counterfeiting, regulatory compliance, and patient safety/adherence, while also enabling cost-effective, on-demand production.10

What role does smart packaging play in mitigating the patent cliff?

Smart packaging, incorporating electronic labels, RFID tags, QR codes, and Time-Temperature Indicators (TTIs), enhances patient adherence (reminders, usage tracking), combats counterfeiting (real-time authentication, traceability), and improves supply chain transparency (monitoring conditions, origin verification).9

Why is an agile supply chain crucial for pharmaceutical packaging?

An agile supply chain provides the flexibility and responsiveness needed to implement trigger-based packaging strategies. It leverages real-time data, automation, and strategic partnerships to quickly adapt to demand changes, manage diverse product portfolios (e.g., generics), reduce inventory costs, and accelerate time-to-market.20

How does sustainability in packaging relate to the patent cliff?

Beyond environmental benefits, sustainable packaging initiatives can lead to operational efficiencies and cost savings in shipping and distribution.17 This aligns with the need for cost reduction post-patent expiry and drives broader innovation in materials and processes.18

What are the main challenges in adopting new packaging technologies?

Challenges include the cost implications of new materials and technologies, ensuring compliance with stringent regulatory standards (stability, sterility, safety), resource availability, and the complexity of integrating new systems with existing supply chains.15

IX. Expert Perspectives: Voices from the Industry

Industry leaders and analysts offer critical perspectives on the patent cliff and the strategies required to navigate it:

- Arda Ural, Health Sciences Markets Leader at EY: Characterizes the looming patent expirations as being of “tectonic magnitude” and notes that they “capture most blockbusters.” He further observes that “R&D productivity is not necessarily corresponding to the R&D investment,” highlighting the industry’s struggle to replace lost revenue through traditional means.1

- Richard Kelly, Senior Partner, Oblon, McClelland, Maier & Neustadt: Differentiates the impact on small molecule drugs versus biologics. He states that for a typical small molecule drug that goes generic, “it really goes off the cliff — 80% of the market can be gone in 30 to 90 days and the price goes down even more.” In contrast, for biosimilars, he explains, ” have to go around to the doctors to sell a drug. It’s just another product in the detail-man’s bag,” implying a slower, less drastic decline than for small molecules.1

- Mara Goldstein, Senior Biopharma Analyst at Mizuho Securities: Raises concerns about the potential disincentives created by the Inflation Reduction Act regarding the development of new indications for follow-on biologic drugs. She questions, “Does it truly create a disincentive to develop indications? Will companies continue to invest in new clinical trials right up to patent cliffs? How does [the law] change the value of dollars invested over time?”.1

- Bill Coyle, Global Head of Biopharma at ZS: Suggests that the industry is “potentially entering an era of fewer blockbusters and a lot more smaller products.” He emphasizes that “the other shift for many of the big pharmas is that their cadence of launch needs to be more efficient and frequent. They need to become more effective launchers of new assets”.1

- Güneri Tugcu, Global Director Partnerships and Business Development, r-pac Europe sarl: Advocates for a more expansive use of smart packaging, stating, “I would love to actually launch a European law that forbids to link to your company website. And I think as brands and service providers here, we should swear that we’ll never do that because that really hurts the capability and the vision of smart packaging. It should be to so much more than just the company website”.14

- Alix Courdier, Global Head of Marketing Technology & Data, Lipton Teas and Infusions: Outlines key challenges in connected packaging, including “supply chain integration,” “accessibility” for inclusive content, “sustainability,” and the need to “encouraging those repeat scans” through loyalty programs and dynamic content.14

- Daniel Diezi, Vice President, Digitalization & New Business Models at Gerresheimer: Highlights the transformative potential of digital twins and blockchain in primary packaging, stating, “We are convinced that our primary packaging will become the key to enable supply networks across organizations and lead to faster process operations and data-informed decision making”.16

- Aptar Pharma CEO (unnamed in source): Notes the cross-industry applicability of packaging technologies, observing that customers often ask, “can I have this pharma device over here in beauty?” This underscores the potential for leveraging innovations across different sectors to enhance pharmaceutical solutions.25

- Lucy Chung (unnamed in source): Emphasizes the importance of early collaboration in design for manufacturability: “Collaboration between machine builders and device designers in the initial stage of device development could significantly increase productivity since designers have first-hand knowledge of designing components most suitable for automation assembly”.26

Works cited

- Big pharma’s looming threat: a patent cliff of ‘tectonic magnitude …, accessed May 30, 2025, https://www.biopharmadive.com/news/pharma-patent-cliff-biologic-drugs-humira-keytruda/642660/

- The Patent Cliff: From Threat to Competitive Advantage – Esko, accessed May 30, 2025, https://www.esko.com/en/blog/patent-cliff-from-threat-to-competitive-advantage/

- Learning from the Pharmaceutical Industry: How to Avoid a Patent Cliff – Caldwell Law, accessed May 30, 2025, https://caldwelllaw.com/news/learning-from-the-pharmaceutical-industry-how-to-avoid-a-patent-cliff/

- Pharma Faces $236 Billion Patent Cliff by 2030: Key Drugs and Companies at Risk, accessed May 30, 2025, https://www.geneonline.com/pharma-faces-236-billion-patent-cliff-by-2030-key-drugs-and-companies-at-risk/

- Patent Cliff: What It Means, How It Works – Investopedia, accessed May 30, 2025, https://www.investopedia.com/terms/p/patent-cliff.asp

- Patent cliff and strategic switch: exploring strategic design possibilities in the pharmaceutical industry – PMC, accessed May 30, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC4899342/

- Biopharma R&D Faces Productivity And Attrition Challenges In 2025 – Clinical Leader, accessed May 30, 2025, https://www.clinicalleader.com/doc/biopharma-r-d-faces-productivity-and-attrition-challenges-in-2025-0001

- 5 Pharma Powerhouses Facing Massive Patent Cliffs—And What They’re Doing About It, accessed May 30, 2025, https://www.biospace.com/business/5-pharma-powerhouses-facing-massive-patent-cliffs-and-what-theyre-doing-about-it

- Pharma packaging: smarter & safer – Packaging Gateway, accessed May 30, 2025, https://www.packaging-gateway.com/features/pharma-packaging-smarter-safer/

- Basics of Variable Data Printing for Manufacturing: QR Codes Explained | Acviss | Blog, accessed May 30, 2025, https://blog.acviss.com/basics-of-variable-data-printing-for-manufacturers/

- Variable Print Labels in Pharma: Adaptable Solutions for Changing …, accessed May 30, 2025, https://www.tapecon.com/blog/variable-print-labels-in-pharma

- Folding Cartons – Variable Data – CCL Healthcare, accessed May 30, 2025, https://cclhealthcare.com/packaging-products/pharmaceutical-folding-cartons/variable-data/

- Pharmaceutical Tracking and Anti-Counterfeiting Technologies …, accessed May 30, 2025, https://www.pppharmapack.com/blog/pharma-tracking-anti-counterfeit-technologies.html

- 10 Quotes from the AIPIA & AWA Smart Packaging Congress, accessed May 30, 2025, https://www.packworld.com/trends/digital-transformation/article/22927553/10-quotes-from-the-aipia-awa-smart-packaging-congress

- Pharma Packaging: Top Challenges and Solutions in 2025 – GreyB, accessed May 30, 2025, https://www.greyb.com/blog/pharma-packaging-challenges-solutions/

- Gerresheimer and Merck Transform Primary Packaging into Digital Twins, accessed May 30, 2025, https://www.gerresheimer.com/en/company/news/detail/gerresheimer-and-merck-transform-primary-packaging-into-digital-twins

- Balancing Safety and Sustainability in DDC Product Packaging – PCI Pharma Services, accessed May 30, 2025, https://pci.com/resources/balancing-safety-and-sustainability-in-ddc-product-packaging/

- How Pharma is Switching to Sustainable Packaging. – World BI, accessed May 30, 2025, https://worldbigroup.com/Event-blogs/pharma-switching

- The Many Facets of Sustainable and Recyclable Blister Packaging for Pharmaceuticals Primary Packaging, accessed May 30, 2025, https://www.healthcarepackaging.com/sustainability/recyclability/article/22932333/the-many-facets-of-sustainable-and-recyclable-blister-packaging-for-pharmaceuticals-primary-packaging

- Adopting Agile Supply Chain Practices for a Competitive Advantage …, accessed May 30, 2025, https://aratum.com/perspective/adopting-agile-supply-chain-practices-for-competitive-advantage/

- Packaging Supply Chains: 5 Features for Powerful Outcomes, accessed May 30, 2025, https://joneshealthcaregroup.com/blog/5-features-of-agile-pharmaceutical-packaging-supply-chains/

- Managing Patent Cliffs in the Pharmaceutical Industry -, accessed May 30, 2025, https://thejournalofmhealth.com/managing-patent-cliffs-in-the-pharmaceutical-industry/

- Three Strategies for Navigating the Pharmaceutical Patent Cliff – Certara, accessed May 30, 2025, https://www.certara.com/blog/three-strategies-for-navigating-the-pharmaceutical-patent-cliff/

- How Companies Can Extract Value from Expired Drug Patents – DrugPatentWatch, accessed May 30, 2025, https://www.drugpatentwatch.com/blog/how-companies-can-extract-value-from-expired-drug-patents/

- AptarGroup CEO: Consumer is still there, but our numbers reflect inventory adjustments post-COVID – YouTube, accessed May 30, 2025, https://www.youtube.com/watch?v=t0wjqR5VX6w

- P12 P20 P40 INDUSTRIALISING DRUG DELIVERY – ONdrugDelivery, accessed May 30, 2025, https://www.ondrugdelivery.com/wp-content/uploads/2019/08/Industrialising-Drug-Delivery-ONdrugDelivery-Issue-99-August-2019.pdf